By Patricia Zeitz, Stephanie Russell and Sam Moore, Bendigo and Adelaide Bank Limited.

Company Description

Homesafe Solutions Pty Ltd (“Homesafe”) is a joint venture between The Szabo Group and Bendigo and Adelaide Bank Limited. It was founded based on a shared vision between the two entities to allow a more comfortable retirement for many, help to address the issue of sustainability of the age pension system and improve intergenerational equity.

The Homesafe Wealth Release® product provides not only a mechanism to access wealth tied up in the family home in a safe and secure manner, but also ensures that the homeowner’s right to live in the home is fully protected. It provides the opportunity for home equity release to become a more meaningful fourth pillar of the Australian retirement income system through releasing more of the equity that senior Australians hold in their homes, whilst they still live in their homes.

The Opportunity

Many aspects of Australia’s social and economic environment are changing. We are experiencing an increasingly ageing population, coupled with substantial medium term appreciation in capital city housing values.

Many older Australians have a substantial investment in their family home yet relatively small capacity for income during retirement, which is often limited to pensions, superannuation and voluntary savings.

Funding retirement while retaining familiar living standards has become a real social issue; not just for retirees but also for the Government. In addition there is the issue of intergenerational equity.

Until the launch of the Homesafe Wealth Release® product in 2005, the main avenues for unlocking home equity were by either downsizing (where cash flow is lumpy and “all or nothing”, transactional costs are high and there is a social impact from relocating) or by way of a reverse mortgage, (where longevity risk largely remains with the retiree and is experienced through compound interest eroding equity in the home). In some circumstances a reverse mortgage is a good option, but it brings the uncertainty of not knowing how large the loan will be. The longer a person lives, the bigger the loan gets and the faster it grows, because of compounding interest.

With the Homesafe Wealth Release® product, there is no debt to grow.

The Strategy

Homesafe’s goal in addressing this increasingly common social issue was to offer an alternative form of equity release providing certainty for the homeowner. Homesafe provides a mechanism to access the wealth tied up in the family home in a safe and secure manner. The equity release product ensures the right of the homeowner to live in the family home is fully protected. Homesafe allows homeowners to access the capital in their home to supplement living standards during retirement, which helps to address the challenge of funding retirement for an ageing population.

Homesafe facilitates the deferred sale of an agreed proportion of the family home. The homeowner sells a percentage of the future sale proceeds of their home in return for an immediate lump sum cash payment of up to $1 million. The homeowner continues to live in the home until they die or decide to sell the property. They make no payments, pay no rent and have control over the property. The homeowner remains the legal owner of the property.

On the sale of the property, which is when the homeowner determines, or on their death, Homesafe will receive a percentage of the sale proceeds, and the homeowner retains the balance. This provides the homeowner with the peace of mind that they will always retain their percentage of the value of their home, not sold to Homesafe. The contract specifically protects the rights of the homeowner to remain in their home for life, or to rent it out and keep the rental income.

Through this model, Homesafe supports older homeowners to release wealth from their homes, without having to take on debt. Homesafe is not a reverse mortgage and continues to be the only debt free way for seniors to access the wealth tied up in their homes, without interest or repayments of any kind. The Homesafe Wealth Release® solution is available to older Homeowners in Sydney and Melbourne subject to certain criteria.

Results – Value for Business and Society

Homesafe continues to receive an increasing number of enquiries and has assisted thousands of older homeowners, providing them with peace of mind in retirement by providing funding to help meet their living needs. Customer testimonials can be found on the Homesafe website using the following link: https://www.homesafe.com.au/testimonials

Homesafe has generated positive social outcomes since 2005 by:

- allowing older Australians the certainty of living in their homes for life, or until they choose to sell; and

- assisting thousands of ‘asset rich, cash poor’ homeowners to achieve a comfortable retirement by enabling access to the wealth tied up in their homes, debt free. Funds have been used to pay down debt, conduct home maintenance, purchase cars and boats, fund travel etc.

Homesafe has also generated strong business outcomes

The model has been highly successful for Homesafe and the joint venture partners. Along the way, Homesafe has created a portfolio that continues to grow. It is also generating a return to its shareholders consistent with investor expectations.

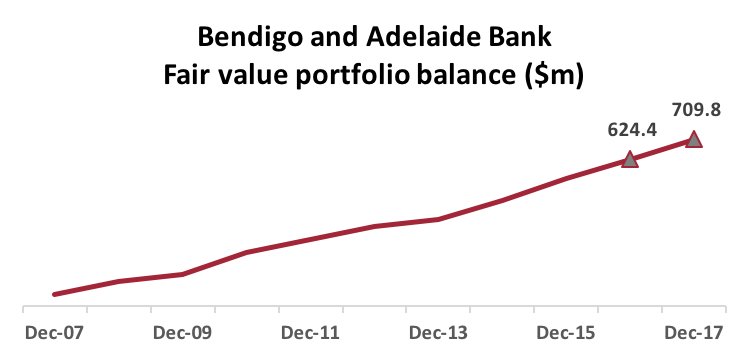

Since 2005 the portfolio has continued to grow. The table below shows the growth of the portfolio since June 2007. As at December 2017 the fair value of the portfolio was $709.8m.

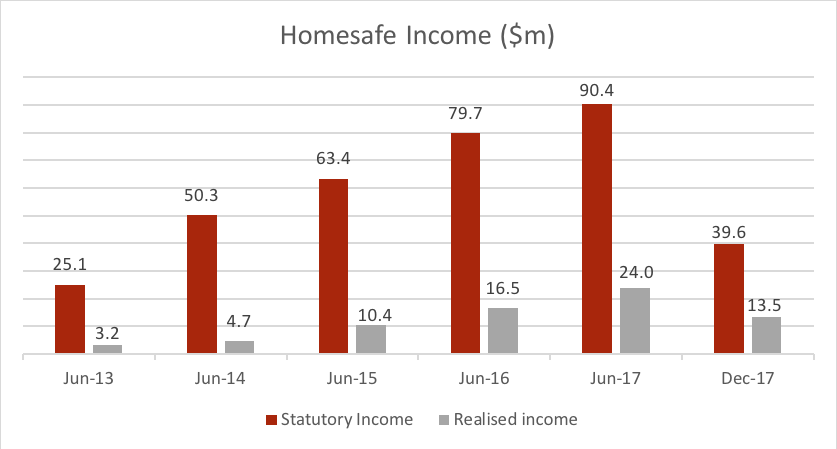

The Homesafe portfolio provides a significant contribution to the financial performance of the Bendigo and Adelaide Bank Group. The graph below outlines both the statutory earnings of the Group, along with the realised income on completed contracts.

All financial values are from the Bendigo and Adelaide Bank annual and half year reports. Please refer to the Bendigo and Adelaide Bank website for further information.

Lessons Learned, Challenges and Outlook

Homesafe is a great example of a successful shared value business model providing solid returns and great social outcomes.

However, it has been a challenge to attract new funding partners. The Bendigo & Adelaide Bank is currently the sole funder of the Homesafe Trust. In order to continue to grow the product and potentially look for opportunities outside the current selected market, funding will be required from other partners. Further funding may assist in this product potentially becoming available to more senior homeowners in expanded geographical areas.

Given the uniqueness of this product it has been a challenge in getting the investor market to understand the product and its contribution to the investor. Over the years there has been continual discussions with potential funders to provide further information on how this product solves the funding needs for older Australians and the recognised contribution it makes both financially and socially.